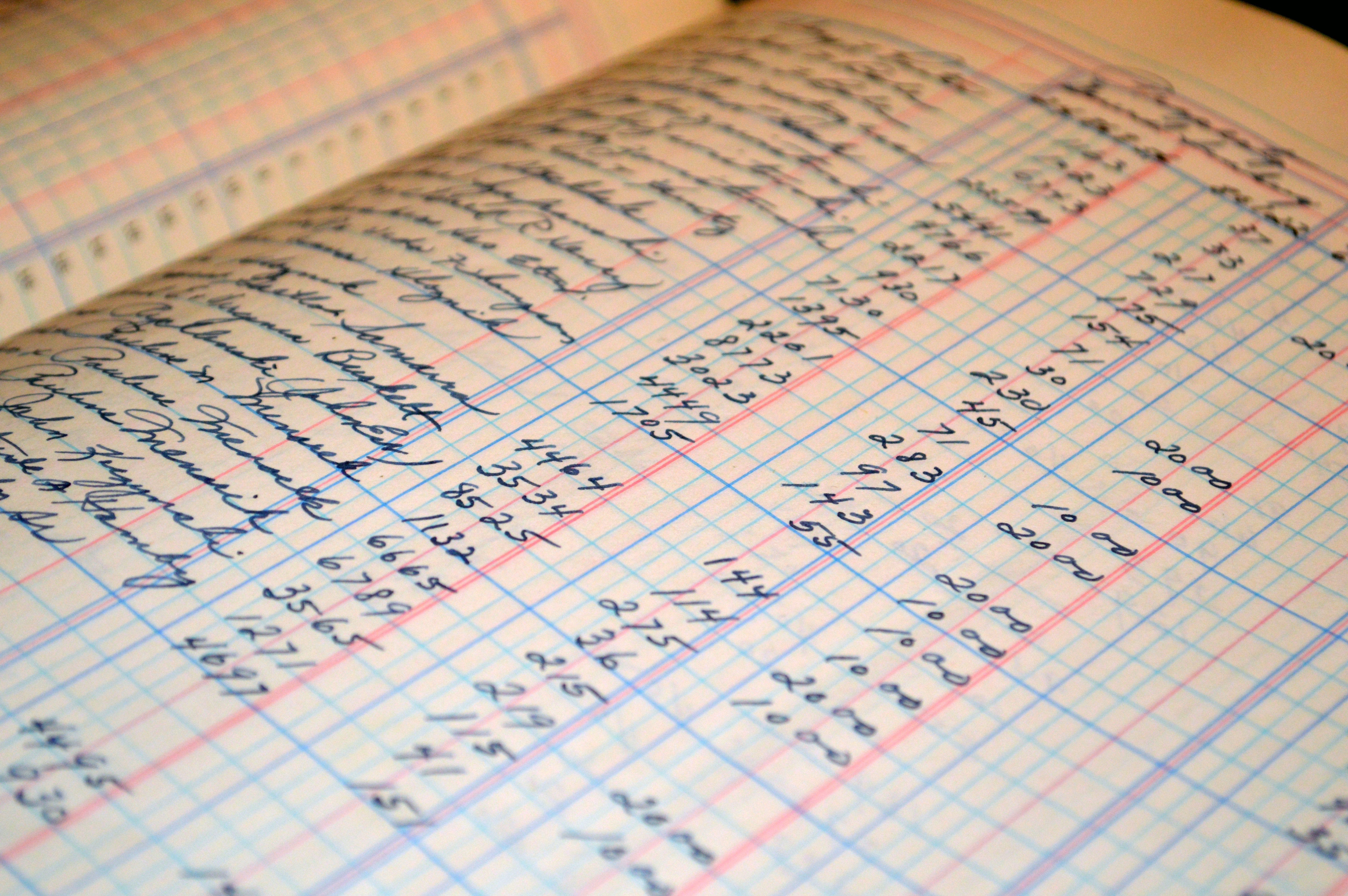

A BOOKKEEPING BUSINESS is one of the examples of an online business you could start.

Small businesses often turn to a bookkeeping business to perform their monthly revenue and expense entries. Bookkeepers are in demand as most businesses and freelancers need to keep records to calculate taxes and manage finances.

You may have the skills and credentials to be an accountant or even a CPA. However, in this article, we are focusing on the bookkeeping side of the business. In many cases, including mine, I don’t want to spend my time learning a bookkeeping program. Since I have an LLC, the revenue and expenses are reported to IRS on my tax return. I have an accounting firm for that responsibility.

However, it is the day-to-day accounting for revenue and expenses to enter into a system such as QuickBooks that I want a bookkeeper to do. And produce the reports for me. I simply enter all of the data into a spreadsheet, match it with my receipts, and send it to a bookkeeper to complete. You can send your documents to a secure vault that many bookkeepers and accountants have. If not and you feel comfortable with it, you can send the documents via Dropbox or even Slack.

If this sounds like a business you would like to pursue, read on.

A typical monthly service would include:

- Bank and Credit Card Reconciliations

- Payroll Liability Reconciliation

- Depreciation Entries

- Month End Reporting

The service may also include gathering the W-9s and the information needed.

What a bookkeeper typically does not do is important for you to clarify with your client.

Normally this level of bookkeeping is done on the Cash, not an Accrual basis, and the bookkeeper usually does not adjust the records to reflect generally accepted accounting principles (GAAP). They do not do an audit or other verification of the data submitted by the client. The reports which contain portions of financial information are for internal management use only. They will not provide any financial statements (other than those used for internal management purposes and subject to interpretation by the client’s CPA or tax professional for tax purposes) and will not perform any compilation, review, or audit of any of the financial information. They do not at any time provide legal services of any type. They will state they have not been requested to discover errors, misrepresentations, fraud, illegal acts, or theft, and therefore, have not included any procedures designed or intended to discover such acts, and the client agrees the bookkeeper has no responsibility to do so.

The services you do and do not provide should be clearly outlined in a document that is signed by the bookkeeper and the client.

Look for a Sample Client Engagement Letter below.

The best part of this kind of business is you can work remotely. You can start a bookkeeping company with low investment costs. You need a computer with bookkeeping software such as QuickBooks and an internet connection. Many small bookkeeping businesses obtain most of their clients by referral. These businesses often network with other small bookkeeping businesses for referral when they or their referral become too busy to handle more clients.

Here’s what you need to start a virtual bookkeeping business:

- Basic computer skills to work as a bookkeeper

- Training to become a certified or skilled bookkeeper

- Bookkeeping practice to ensure efficient record keeping, data entry, cash flow management, etc.

- Know-how of accounting software that you’ll use to provide bookkeeping services to your clients

- Good communication skills to get clients, negotiate with them, and collaborate efficiently

If you want to become an accountant for larger businesses, the highest level is passing the CPA exam to become a Certified Public Accountant that people and businesses can trust.

Decide on the bookkeeping services that you can offer your clients. Some of the services may include:

- Creation of basic financial statements such as balance sheet and cash flow statement

- Invoicing

- Accounts payable management

- Accounts receivable management

- Payroll services

A bookkeeping business may be for you if you want to work from home and you are good at figures and math, a virtual bookkeeping business may be an option for you.

Better yet, you can learn how to build your virtual bookkeeping business from scratch with online courses. Check out https://trailblazerpod.wpengine.com/BookkeepingCourses. I particularly like this company because of the way they approach their services - and they have many high-profile supportive companies.

Since I only support companies I believe in, I may receive a small affiliate commission if you purchase from them.

CLIENT ENGAGEMENT LETTER

A sample engagement letter could be worded like this:

SAMPLE BUSINESS ENGAGEMENT LETTER

Your Business Name, Address, and Phone Number

TO: (client’s business name, address, and phone number)

Dear xx:

We appreciate the opportunity of providing you with a proposal for Bookkeeping and Consulting Services. To ensure a complete understanding between us, this letter will describe the scope and limitations of the services we will provide for you. ________ will be the contact person for this engagement.

What We’ll Do

The Firm shall provide the Services and Deliverable(s) as follows:

Accounting & Bookkeeping – Basic monthly service which can include:

- Bank and Credit Card Reconciliations

- Payroll Liability Reconciliation

- Depreciation Entries

- Month End Reporting

What We Won’t Do

We will make no attempt to adjust the records to reflect generally accepted accounting principles (GAAP). We will make no audit or other verification of the data you submit. We may provide reports which contain portions of financial information; these reports are for internal management use only. We will not provide any financial statements (other than those used for internal management purposes and subject to interpretation by your CPA or tax professional for tax purposes) and will not perform any compilation, review, or audit of any of the financial information. We do not at any time provide legal services of any type. We have not been requested to discover errors, misrepresentations, fraud, illegal acts, or theft, and, therefore, have not included any procedures designed or intended to discover such acts, and you agree we have no responsibility to do so.

What We Need from You

to complete the service, we will need to obtain information on a timely and periodic basis from your organization. These items include the data file, supporting documents, answers to any questions we might have, and any other information that we may require to complete the work of this engagement. These items and any other items that we obtain from you will be based on information provided by you and will be used without any further verification or investigation on our part.

When We’ll Do It

This engagement will begin on or about ______. This engagement is made on a time-and-materials, best-efforts basis.

Services Outside the Scope of this Letter

You may request that we perform additional services at a future date not contemplated by this engagement letter. If this occurs, we will communicate with you regarding the scope and estimated cost of these additional services. Engagements for additional services will necessitate that we issue a separate engagement letter to reflect the obligations of both parties.

Fees

Our fee for these services will be $xx per hour for bookkeeping and $xx per hour for consulting. We are pleased to have you as a client and hope this will begin a long and pleasant association. Please date and sign a copy of this letter and return it to us to acknowledge your agreement with the terms of this engagement.

Sincerely,

(Your name) (Date)